For DE 🇩🇪 and AT 🇦🇹

Submit monthly Intrastat declarations correctly and stress-free – we take care of it for you

Avoid fines, save time, and gain security with our professional Intrastat service.

Intrastat declarations: Invisible obligation, costly risks

Anyone who overlooks Intrastat obligations or makes mistakes risks fines of up to €50,000. Complex requirements and tight deadlines make reporting a real challenge.

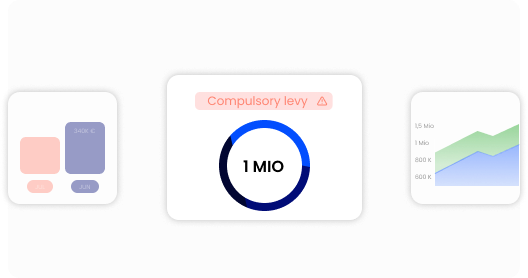

Obligations & reporting values

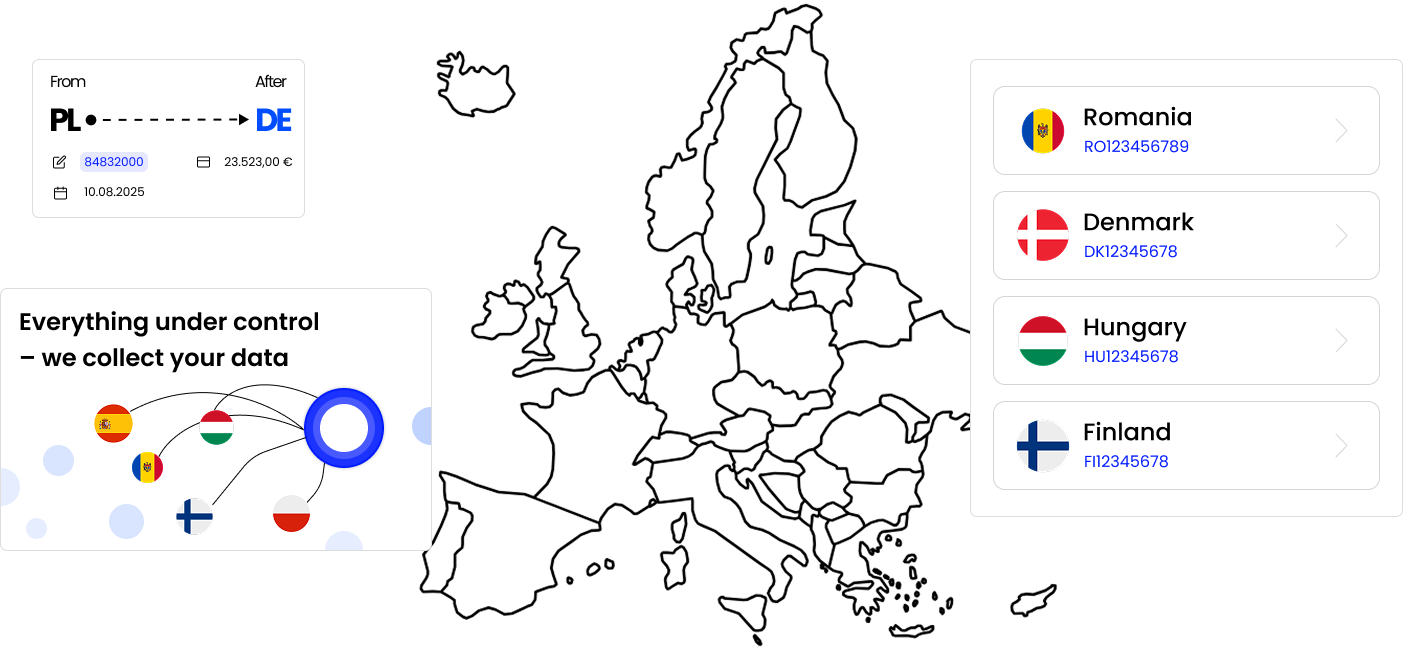

Companies are required to submit Intrastat declarations as soon as they exceed the reporting thresholds – in Germany: arrivals €3.0 million, dispatches €1.0 million; in Austria: arrivals €5.0 million, dispatches €1.2 million.

Complex requirements

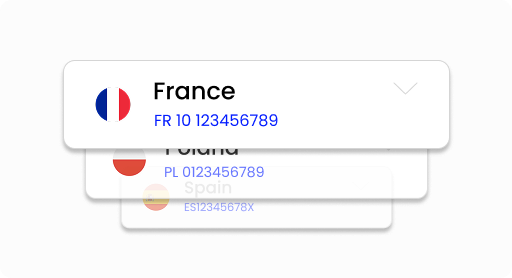

The legal requirements are extensive. Mandatory information such as the country of origin and the VAT ID of the trading partner are required. Errors in data entry or missed deadlines can easily occur.

Consequences of violations

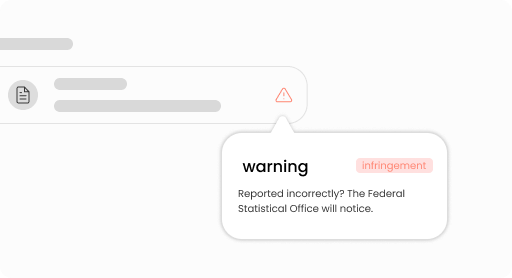

Late or incorrect reports result in fines of up to €50,000. In addition, there are audits by the Federal Statistical Office, additional administrative work, and the risk of falsified key figures.

We take care of your Intrastat declarations – legally compliant and reliable

With our service, we take care of the entire processing of your reports. You can rest assured that all information will be transmitted correctly and on time—without stress and without the risk of rework.

Preparation and timely submission of all reports

Companies that exceed the reporting threshold for arrivals or dispatches in intra-Community trade are automatically required to submit an Intrastat declaration—without notification from the authorities.

Ongoing support for your registrations

We keep a constant eye on your notifications so that you don’t overlook any obligations and can be sure that everything is done on time.

Knowledge of EU regulations and thresholds

Benefit from our experience with national and international companies. We combine in-depth expertise with efficient processing to make the process as easy as possible for you.

Your advantages – our solution for less stress and more security

With us, you save time, avoid fines, and gain complete certainty with your Intrastat declarations. We take care of all the details—so you can focus on your business.

Protection against fines

Your reports are always correct and on time – without the risk of heavy penalties.

Time saving

You concentrate on your business, we take care of the bureaucracy.

Expert knowledge

Complex requirements such as country of origin and VAT ID are routine for us.

Personalized support

A personal contact person will take care of your concerns—no hotline.

Transparent costs

Clear prices with no hidden fees give you complete planning security.

Future-proofing

Always up to date – we keep you legally on track.

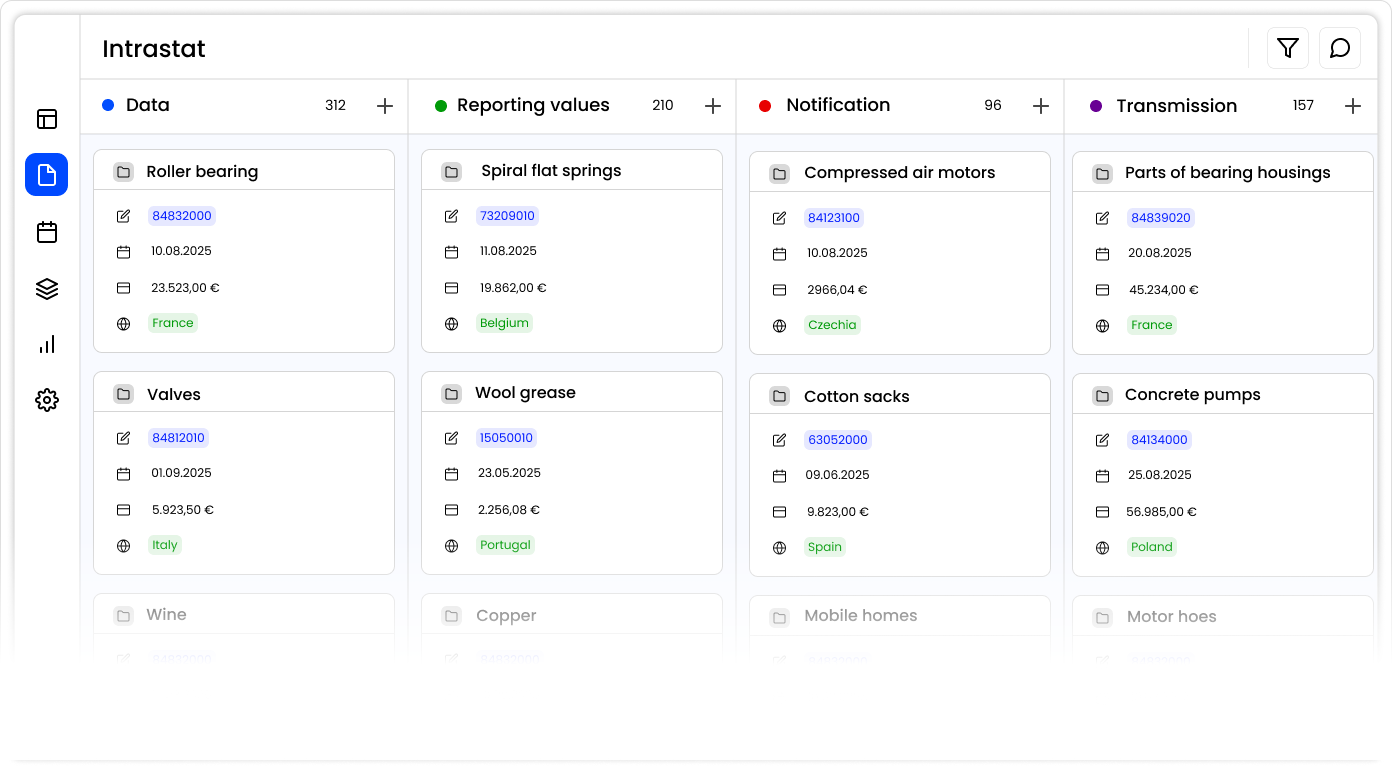

Seamless connection - Your company & Intrastat

With our solution, your trade data is transferred directly to the Intrastat declaration—quickly, accurately, and in compliance with legal requirements. This helps you avoid fines, save time, and focus on your core business.

This is how Intrastat reporting works with us

A clear, simple process ensures that your reports are delivered reliably and on time to the Federal Statistical Office—without you having to worry about the details yourself.

Transmit data

You send us your relevant trading data – quickly and easily.

Inspection & Preparation

We check the information, fill in the mandatory fields (e.g., country of origin, VAT ID) and prepare everything ready for submission.

Creation & transmission

The report is prepared in a legally compliant manner and submitted to the Federal Statistical Office within the specified time limit.

Confirmation & Support

You will receive confirmation and will have a contact person available at any time should you have any questions.

Questions & Answers

Here you will find the most important questions about Intrastat declarations—answered clearly, comprehensively, and concisely. This way, you will immediately know what your company can expect and how our service can help you.

What is an Intrastat declaration in Germany?

An Intrastat declaration is the statistical recording of goods traffic between Germany and other EU member states. It is collected in Germany by the Federal Statistical Office (Destatis) in order to accurately reflect intra-Community trade in goods. Companies subject to reporting requirements report the required data from their EU deliveries or their EU purchases, or from both directions of traffic, on a monthly basis.

The mandatory reporting parameters include:

- Statistical goods number (8 digits from the goods directory for foreign trade statistics)

- Country of dispatch/country of destination

- VAT ID number of the recipient of the goods in the country of destination

Country of origin (country of production) - State

- Net weight

- Special units of measurement such as pieces, liters, grams, etc.

- Invoice value

- Type of transaction

- Mode of transport (type of transport)

Coded information and key numbers from the corresponding code lists must be used (country directory).

What is an Intrastat declaration in Austria?

An Intrastat declaration is the statistical recording of goods traffic between Austria and other EU member states. It is collected in Austria by Statistics Austria in order to accurately reflect intra-Community trade in goods.

Companies subject to reporting requirements report the required data from their EU deliveries or their EU purchases, or from both directions of traffic, on a monthly basis.

The mandatory reporting parameters include:

- Statistical goods number (CN8 code – Combined Nomenclature)

- Country of dispatch / country of destination

- UID number of the recipient of the goods in the country of destination

- Country of origin (country of production)

- Net weight

- Special units of measurement such as pieces, liters, grams, etc.

- Invoice value

- Statistical value

- Type of transaction

- Mode of transport (type of transport)

Coded information and key numbers from the corresponding code lists (country directory) must be used. Net weight, invoice values, and special units of measurement must be specified with up to 3 decimal places.

Who has to submit Intrastat declarations?

All companies that are subject to VAT in their respective EU country and ship goods to or purchase goods from other EU member states are generally required to register, provided that certain thresholds are exceeded in the previous year or the current year. If the threshold is only exceeded in the current year, the registration requirement arises automatically from that month onwards.

Intrastat reporting threshold in Germany:

- For shipments: from €1,000,000

- For arrivals: from €3,000,000

Intrastat reporting threshold in Austria:

- For shipments: from €1,200,000

- For arrivals: from €5,000,000

The Intrastat reporting thresholds for other EU countries vary from country to country and are published by the local statistical authorities.

What happens if I don't submit the report?

Companies that fail to comply with their reporting obligations are committing an administrative offense. In such cases, the Federal Statistical Office can impose a fine of up to €50,000. In addition, the reports must still be submitted at a later date—the risk: financial burden, damage to reputation, and unnecessary audit procedures.

Can I also use the service at short notice?

Yes—our service is flexible. Even if you realize at short notice that you need to submit Intrastat declarations or deadlines are approaching, we will take care of the entire process quickly, reliably, and on time. This helps you avoid stress, errors, and fines.

How much does it cost?

The costs depend on the scope and complexity of the reports (e.g., number of monthly goods deliveries, data preparation, special cases). Our transparent pricing model ensures that you have planning security—with no hidden fees. On request, we can provide you with a customized quote tailored precisely to your company.